Why We Are Different

Welcome to the Family

- Independent Insurance Agency Knowledge of and access to a wide coverage across carriers and more.

- Customer Service Liaisons Handle all the customer service claims. Touched and handled by your team. If there is a problem we solve.

- Our Customers Are Our Family Too It’s about you. Not the insurance. You need peace of mind and the right coverage for you and your family.

The Family

Meet Your Goon Squad

OUR EXTENDED FAMILY

The Eye Witness

Testimonials

Kelly

I had a great experience working with Anthony! I was without health insurance and in need of some help to find the right plan. Anthony spent so much time and energy to help me, personally, find the best plan that would work for me. I truly appreciate the service he provided, and he is the person I will go to in the future if/when I need to change plans. I got the impression that he truly cared.

Eva

We were very grateful for the service you provided when we did not have any health insurance. You answered questions and were very helpful in getting us money back from doctor visits when possible. We have insurance now through an employer. I can’t thank you enough for even trying to help my adult daughter and letting her know the best possible route she should take for her circumstances at the time.

Alex

I LOVE YOU TONY

TONY NUMBER ONE

Janna

Tony you’re the man!!! You have helped me navigate the insurance world more than I could ever explain! We’re going on a 2yr relationship! But what I admire the most about what you’ve created is being able to send close friends and family your way and how much you’ve helped them! I live in Alabama but I’ve referred you to my friends/family who live all over the US! Keep up the good work and know you have a long term relationship with me!

Janine

Anthony has been a great resource for me and my familie’s insurance needs. When I left my W-2 position to 1099, he found the best prices for the best plans to fit our needs. Plus he is the nicest guy!!

Steven

I appreciate the time you spent finding and explaining the health plan my wife and I ultimately picked and continue to use today. It has worked extremely well for our family, and we have every bit of confidence in coming back to you for all our future needs with regards to health care plans.

Joanne

Our family has always had group health insurance through my husband’s employers until 2022. It was impossible for me to figure the best healthcare choice for our family. I am so thankful I found Tony through the positive reviews posted on our local mom’s group on Southlake. His knowledge of the insurance marketplace enabled us to (fairly) easily figure out the best (coverage/economics) choices to cover all the members of our family. Now, if I have a question, I just call him. I’m not surprised his business has expanded enough to go from “The Man with the Healthcare Plan” to “The Health Insurance Syndicate”. I recommend him to everyone.

Andrea

When I started my transition into self-employment I was very confused about obtaining insurance for myself. Anthony made it so easy. He took the time to ask me my needs and explain different healthcare plans to me. It was a wonderful experience working with him. He cares about what you need, not about selling you something you don’t need.

What To Know

An HMO is a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage.

A PPO is a type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan’s network. You can use doctors, hospitals, and providers outside of the network for an additional cost.

In-network providers are those medical professionals who have an agreement with your insurance company to provide services at a discounted rate. Out-of-network providers are not contracted with your health insurance company and can typically charge higher rates, which could result in higher out-of-pocket costs for you.

A deductible is the amount you pay for health care services each year before your health insurance begins to pay. For instance, if your deductible is $1,500, your plan won’t pay anything until you’ve met your $1,500 deductible for covered health care services.

A copay is a fixed amount you pay for a covered health care service, usually when you receive the service. This can vary by the type of covered health care service.

Coinsurance is your share of the costs of a covered health care service calculated as a percent (for example, 20%) of the allowed amount for the service. You pay coinsurance plus any deductibles you owe.

The out-of-pocket maximum is the most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits.

The premium is the amount you pay to your insurance company every month (or quarter, semi-annually, or annually, depending on your arrangement) to maintain your health insurance coverage.

Prescription drug coverages are a component of your health insurance plan that helps pay for prescription drugs. Coverage varies by plan, with some plans covering a wider range of medications or offering better cost-sharing rates than others.

A pre-existing condition is a health problem you had before the date that new health coverage starts.Insurers can’t refuse to cover you or charge you more due to pre-existing conditions, on the Marketplace. Some underwritten, short term and sharing program policies can deny cover for pre-existing if not disclosed in the application process.

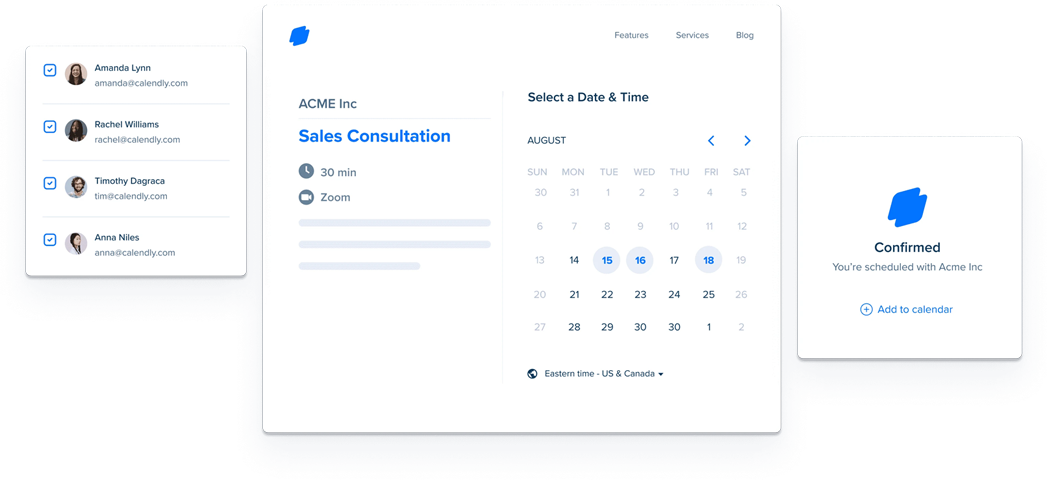

Schedule a call with our Team.

You Talking to Me?! You Should Be.

To better serve your insurance needs, we’d like to schedule a call with one of our advisors. This is a great opportunity to address your questions and concerns directly. Please use our online scheduling tool [insert link here]. We’re eager to assist you with your insurance journey.

The Brains

The Brains The Money

The Money